The concept of stock and flow is mainly used while computing the national income of a country. There are a number of terms related to national income which are classified into stock and flow. For Example: While savings is stock, investment is a flow, the distance between two places is a stock, but the speed of the vehicle is a flow. Similarly, income is a flow, whereas wealth is a stock.

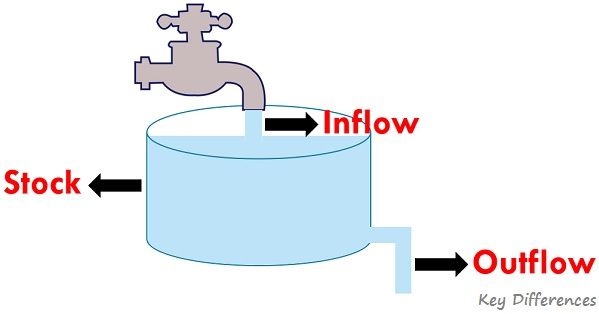

So, what we have understood with the given examples is that stock implies the reserve of inventory or funds, on a specific date. But when we talk about flow, it refers to the inflow or outflow of any economic variable, over a period of time.

Now, we will look at the important differences between stock and flow, using relevant examples.

| Basis for Comparison | Stock | Flow |

|---|---|---|

| Meaning | Stock is basically the accumulated or available quantity of any commodity at a particular moment. | Flow implies the movement of the commodity, from the source to destination, over a period. |

| Nature | Static | Dynamic |

| Measurement | Quantity of economic variable, which is measured at a particular point in time. | Quantity of economic variable, which is measured at a particular period of time. |

| Indicates | Level | Rate |

| Reflects | State of the economy at a specific time. | Changes in the economy, over an interval of time. |

| Measured in | Units | Per unit of time |

| Time dimensional | No | Yes |

| Mutual Interdependence | Stock influences flow | Flow influences stock |

In economics, the term ‘stock’ means the total quantity of goods, assets, liabilities or funds which is stored or is ready for distribution or sale or simply held by a firm on a given date.

Further, the measurement of the stock is performed at a particular time and so it indicates the quantity present at that point in time, for instance, March 31, 2020. And the quantity of that asset or commodity is collected in the past.

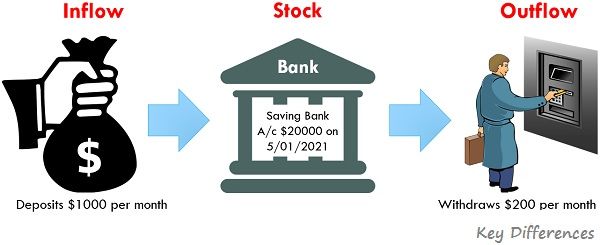

In accounting, stock implies positions in or holdings of the total value of an asset (both financial and non-financial) and liabilities at a Balance Sheet date.

For example:

In economics, the term ‘flow’ indicates the movement of any asset, goods or funds, from one place to another and its measurement is performed over an interval of time. Here, the term ‘interval of time’ determines the duration or length of time, in which the flow of the asset or commodity is measured.

Further, the flow is measured referring to the time, and so its measurement would be done per unit of time, i.e. per house, per day, per year and so on.

In the case of accounting, flow implies the total value of transactions, relating to the purchases and sales of goods, that took place during a particular financial year.

For Example:

The points given below state the difference between stock and flow:

To simply understand the concept of stock and flow we will take some real-life examples:

| Stock | Flow |

|---|---|

| Water in a reservoir | Water in a river |

| Total number of cars. | Cars manufactured during the year. |

| Number of oil refineries. | Refining of oil. |

| Capital | Capital formation |

| Wheat stored in the warehouse. | Sales of wheat in a year. |

| Bank Balance | Savings and Withdrawals from bank. |

So, it is quite clear from the above explanation that stock is a snapshot of the accumulated reserve of the commodity, at a particular point. On the other hand, flow is basically the operations which cause the stock to rise or fall.

Let’s take a common example of a company’s financial statement. If we want to know the stock we always go for the Balance Sheet, but if we want to know the flow, then we check the income statement.